Fha Loan Rate Calculator

Contents

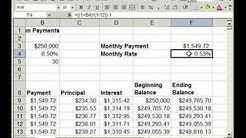

That payment amount includes the core loan payment covering principal and. Current local mortgage rates are displayed below, so you can periodicially revisit .

That payment amount includes the core loan payment covering principal and. Current local mortgage rates are displayed below, so you can periodicially revisit .

If you are considering an FHA Loan, these calculators are useful – Buy vs Rent. current rent, the interest rate on your mortgage and the yearly property taxes.

Current Interest Rate 30 Year Fed Funds Rate Chart History Fed Mortgage Interest rate hybrid adjustable Rate Mortgages offer the consumer a low interest rate for a certain period of time. Then, they increase or adjust to the current rate after fixed rate period has elapsed. These rates can be an entire point lower than 30 year fixed rates.The Effective federal funds rate is the rate set by the FOMC (Federal Open Market Committee) for banks to borrow funds from each other. The Federal Funds Rate is extremely important because it can act as the benchmark to set other rates. Historically, the federal funds rate reached as high as 22.36% in 1981 during the recession.View current home loan rates and refinance rates for 30-year fixed, 15-year fixed and more. Compare rates to find the right mortgage to fit your goals.. Save on interest compared to a 30-year fixed loan, and get a low, fixed monthly payment for the life of the loan.. Mortgage rates could.

The FHA’s online What’s My Payment calculator. You’ll need to input the following information: Purchase price Size of your down payment Interest rate Loan term State in which the home is located The.

This value is then compared with the $726,525 FHA lending limit to determine. Exhibit 1.1: HECM Calculator-Net Available Line of Credit or Tenure Payment for a Variable-Rate Loan.

You can use a mortgage calculator to dig into the different parts of your mortgage. The combined rate equals your interest rate plus the mortgage insurance premium (MIP) rate. FHA loans usually.

FHA Loan Calculator – Check Your FHA Payment FHA loans require just 3.5% down, and are ultra-lenient on credit scores and employment history compared to other loan types.

National Mortgage Interest Rate Rates for. homeowners carry mortgage debt,” the Harvard researchers noted. In 2016, 41% of owners 65 and older owed money for their homes, more than double the 20% share from 1989. It’s true that.

Want to learn how long it will take you to pay off your mortgage? Run the numbers through Bankrate’s mortgage calculators. FHA mortgage disadvantages Since an FHA loan permits a lower down payment,

Others get a mortgage refinance to pay off the loan faster, get rid of FHA mortgage insurance or. your new interest rate.

Technology has made it easier for the borrowers to compare interest rates offered by different lenders. Before you take a.

Interest Rates Daily History This tool allows you to make side-by-side comparisons of changes to the Bank Rate and the target for the overnight rate over time. Policy Interest Rate Changes in the key interest rate influence other interest rates, and so affect people’s spending decisions.

An FHA-approved mortgage lender can let you know the mortgage insurance premium rate that applies to your loan scenario. You can also get an idea of what your mortgage insurance premium would look.

September 2019 mortgage rates forecast (fha, VA, USDA, Conventional). fha mortgage rates.. read more about FHA costs and requirements on our FHA loan calculator page.

Use our free FHA loan calculator to estimate how much your monthly mortgage payments will be with a FHA interest rate mortgage. To calculate your FHA mortgage payments, add the cost of your home in the field and select calculate my payment. How much will your home cost? minimum home value amount is {{minHomeCost}}